You Chose to Electrify...

Let's Turn That Into Revenue

PineSpire manages everything from registration to revenue for our client partners.

The Low Carbon Fuel Standard (LCFS) program in California and Oregon’s Clean Fuels Program (CFP) offer electric fleets an additional revenue stream to pay down the cost of electrification. LCFS and CFP credits can be generated directly by fleets charging their own electric equipment, and these credits are turned into revenue to offset electricity costs and reduce total cost of ownership for electrification.

These programs give fleets an opportunity to earn additional revenue by using eligible electric equipment including public and employee charging stations, refuse trucks, vans, buses, forklifts and other cargo handling equipment, yard trucks, and transportation refrigeration units. To see how much you could be earning, Use our INCENTIVE ESTIMATE CALCULATOR.

PineSpire helps clients earn LCFS and CFP credits directly to maximize revenue generation and meet your company’s sustainability goals.

PineSpire’s experts understand the complex LCFS and CFP markets, and do the hard work so you can save time while earning additional revenue with your EV program.

Electrification Planning

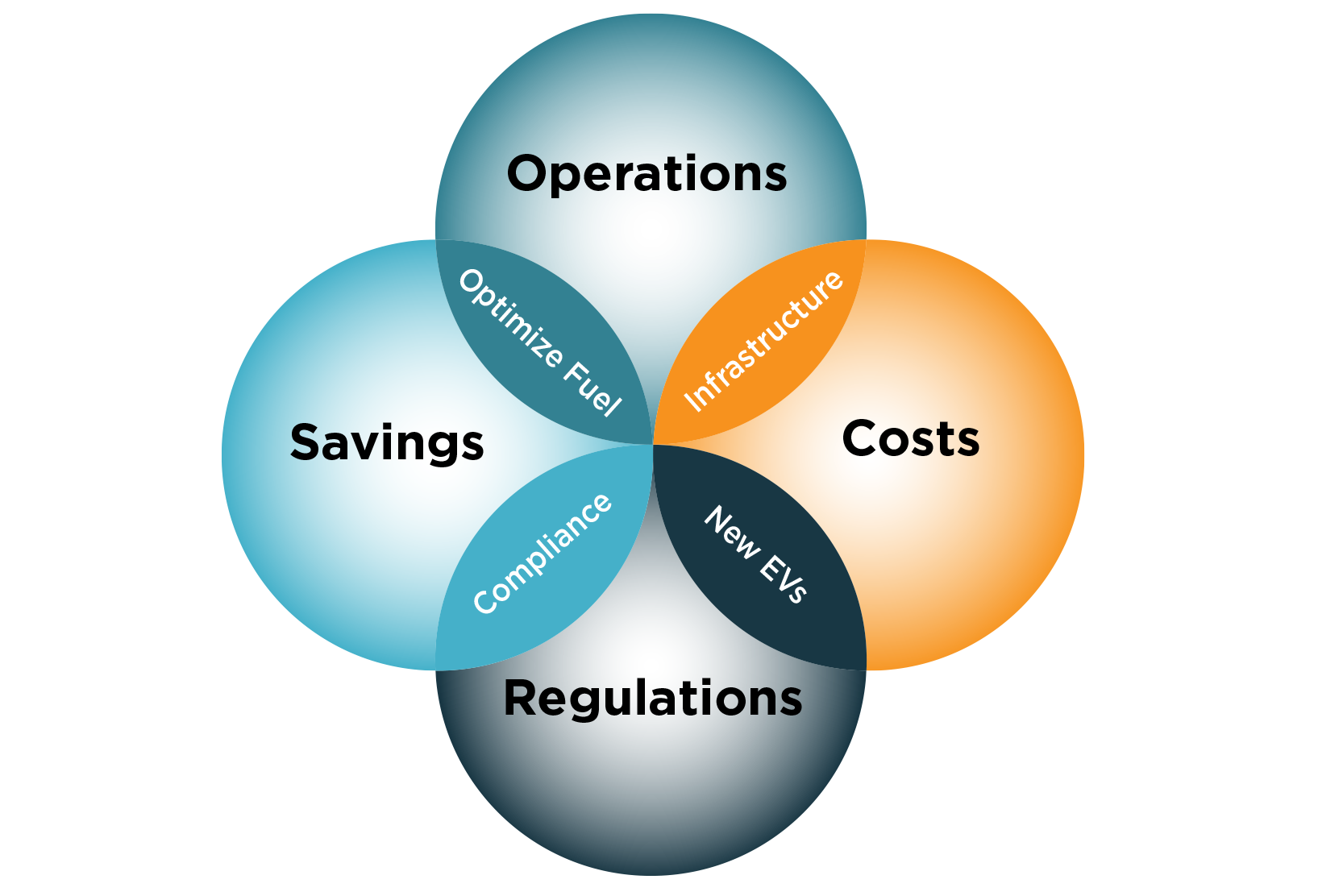

PineSpire can help you develop a comprehensive plan for future fleet electrification while meeting regulatory requirements and your operational priorities. Plan components include Operations, Costs, Savings, and Regulations.

Inventory Your Equipment

To find out more about eligible equipment, click here.

The LCFS and CFP Marketplace

It’s complicated. But PineSpire does the work for you.

Learn More About LCFS

and

Learn More About CFP

As Your E-Fleet Grows

So Does Your Revenue

Case Studies

PineSpire has compelling case studies to share with you, for example:

Electric Vehicle Charging Stations

Learn more about the annual LCFS or CFP Revenue based on Vehicle Class and Typical Usage where, for example, 20 Public or Staff EV Chargers can generate $11,500 per year!